In recent years, the rise of Bad Bunny, Karol G, and Feid has firmly established reggaeton as part of the global mainstream. What began with roots in Latin America is no longer a “regional sound” but a massive market consumed worldwide. Yet in contrast, reggaeton’s presence in Japan remains minimal. This article uses primary industry data to compare the scale of the global market with Japan’s and explores the reasons for this disparity and the possibilities for the future.

The Global Market: Latin Music Leads the Way

According to the IFPI Global Music Report 2024, the global recorded music industry reached $28.6 billion (approx. ¥4.2 trillion) in 2023【IFPI, 2024】. A major driver of this growth has been Latin music. The report shows Latin music grew by 14.8% year-on-year, bringing its share of the global market to around 6–7%.

Streaming plays an outsized role. The Recording Industry Association of America (RIAA) reports that in the U.S., over 97% of Latin music revenue comes from streaming, surpassing even hip-hop【RIAA, 2024】. Latin America itself has also expanded rapidly, with recorded music revenue rising 19.4% year-on-year in 2023 (IFPI, 2024).

This growth is reflected in pop culture milestones: Bad Bunny’s albums topping the U.S. Billboard charts, and Karol G becoming the first woman ever to hit #1 on the Billboard 200 with a Latin album. Overall, the Latin music market is now estimated at around $1.5 billion (approx. ¥220 billion), with reggaeton at its core.

The Japanese Market: A Giant Without “Latin”

Japan remains the world’s second-largest music market. Omdia reports that Japan’s music streaming revenue reached ¥123.3 billion in 2024, up from ¥116.5 billion the year before【Omdia, 2025】. Yet within this enormous market, there is virtually no dedicated category for “Latin” or “reggaeton.”

The Recording Industry Association of Japan (RIAJ) does not provide a “Latin” category in its statistical breakdowns. Instead, categories are dominated by J-POP, anime, and Western pop/rock. In other words, Latin music is statistically invisible. By conservative estimates, Latin/reggaeton accounts for less than 1% of Japan’s market, or under ¥5 billion.

Another distinctive feature is Japan’s continued reliance on physical formats. According to Believe’s report, around 66% of Japanese music revenue still comes from CDs and other physical media【Believe, 2024】. While the world has shifted to streaming, Japan’s unique consumption patterns create an environment where streaming-driven genres like reggaeton struggle to take root.

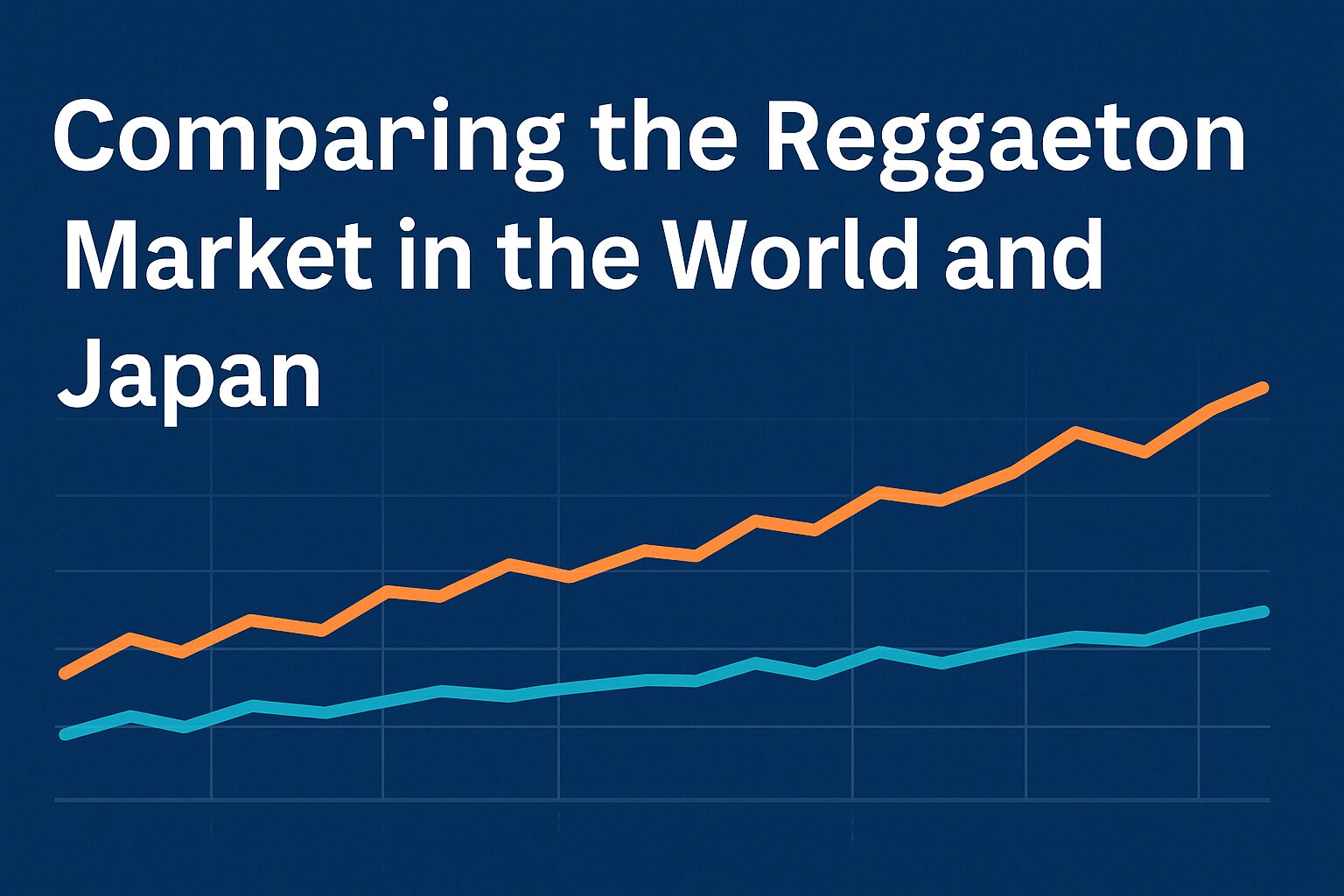

Numbers at a Glance: World vs Japan

Global Market

- Total revenue: $28.6 billion (approx. ¥4.2 trillion)

- Latin music: $1.5 billion (approx. ¥220 billion) — 6–7% share

- Growth rate: +14.8% YoY

Japanese Market

- Total revenue: approx. ¥1.2 trillion (streaming: ¥123.3 billion)

- Latin/reggaeton: under ¥5 billion (<1% of market)

- Statistical treatment: no “Latin” category, effectively untracked

👉 The result: while reggaeton is a major global genre, in Japan it is almost nonexistent. The share gap is more than sixfold.

Background Factors and Further Analysis

Why has reggaeton failed to gain traction in Japan?

The reasons include language barriers, lack of exposure in mainstream media, disconnect with domestic dance culture, and Japan’s heavy reliance on physical music sales.

We explore these cultural and structural factors in detail here:

👉 Why Hasn’t Reggaeton Caught On in Japan? Detailed Analysis

Looking Ahead: Live Events as a Turning Point

The outlook isn’t entirely bleak. Among younger Japanese audiences, awareness of reggaeton is slowly rising, with SNS and TikTok helping songs trend. The biggest catalyst, however, could be live performances.

In 2026, Bad Bunny is scheduled to perform in Tokyo, a historic milestone for reggaeton in Japan. Global artist tours have a direct impact on Spotify and YouTube listening behavior, and this concert could raise Latin music’s profile on streaming platforms domestically.

Crossovers with Latin house and Afrobeats, combined with exposure through clubs and festivals, could also accelerate adoption. From a market perspective, reggaeton in Japan is starting from “zero,” but that also means the growth potential is limitless.

Conclusion

- Globally, Latin music has grown to $1.5 billion, a 6–7% share of the market.

- In Japan, Latin/reggaeton is less than 1%, estimated under ¥5 billion, effectively “nonexistent” in statistics.

- Cultural and structural factors explain this gap, explored in detail in a separate article.

- The key opportunity lies in live events, such as Bad Bunny’s Tokyo show in 2026, which could spark a real breakthrough.

Understanding this gap is essential not just for comparing markets, but for envisioning strategies to grow Latin music in Japan.

コメント